The global surge in battery electric vehicle (BEV) adoption has gained momentum in recent years, as countries worldwide prioritise the shift towards carbon neutrality, in which BEVs are a critical component of the transformation. Notably, China, the world’s largest automotive market, has spearheaded the mass production and development of BEVs, leveraging proactive policies and incentives from the government to drive the electric vehicle industry’s growth and secure its position as the global leader in BEV manufacturing and sales.

Simultaneously, the ASEAN region has now emerged as a significant market in the BEV sector. Driven by escalating environmental concerns and commitments to achieving carbon-neutrality objectives, ASEAN countries have recognised the potential of electric mobility and its role in the future of the automotive industry. Several of them have implemented bold measures to stimulate the adoption of BEVs. Let’s explore some of the notable incentives introduced by key ASEAN nations:

Malaysia’s tax-free period and refund for BEVs:

Malaysia has taken a step forward by implementing a tax-free period for BEVs, along with a small tax refund. This initiative is aimed at encouraging more consumers to embrace electric mobility and expand the BEV ecosystem.

Indonesia’s corporate incentives for local BEV production:

To bolster the local BEV industry, Indonesia has introduced incentives for OEMs willing to produce BEVs within the country. Additionally, Indonesia is aiming to offer a zero percent import tax rate for BEVs to speed up the domestic battery electric market.

Thailand’s comprehensive BEV promotion:

Thailand has adopted a dual approach, offering both demand and supply-side incentives to promote the adoption of BEVs. A notable initiative is the provision of a subsidy of THB 150,000 to consumers purchasing a BEV, with a condition that OEMs must produce at least the same number of BEVs domestically in 2025. Additionally, the Thai government provides tax incentives to encourage participation in the local BEV production industry.

The rise of BEVs alongside Chinese OEMs

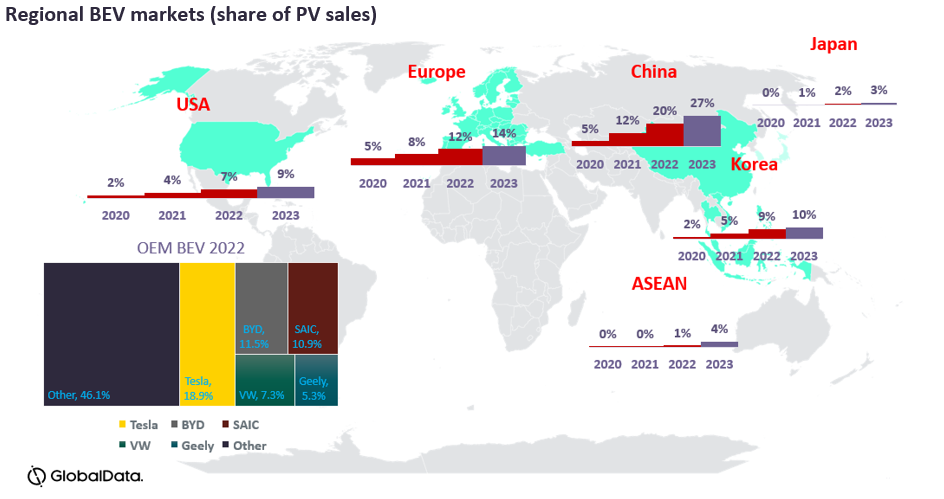

These policies have led to bright prospects for BEV growth in this region. In 2023, BEV sales are expected to increase significantly to around 86k units, growth of 250% over 2022. The majority of ASEAN BEV sales will come from Chinese OEMs which are expected to account for over 70% of total BEV sales this year. Notably, five Chinese OEMs (MG, Great Wall, Neta, Wuling, and BYD) have already invested in this region with more Chinese OEMs like Chery expressing interest in launching products, signifying the growing influence of Chinese OEMs in the ASEAN region. BEV sales are forecast to grow by at least 27% CAGR this decade, while Chinese OEMs will contribute more than half of the region’s BEV sales and dominate the segment. This success will be a stepping stone for these OEMs to expand to other vehicle types in the region as well.

But despite the growing success of Chinese OEMs in the ASEAN BEV market, BEV share in the region will be less than 10% of total PV sales even by the end of this decade. Additionally, Chinese OEMs still face challenges in capturing a significant market share outside of the BEV segment which remains dominated by Japanese OEMs. Japanese manufacturers will continue to focus on internal combustion engines (ICE) and hybrid technologies during this decade. Therefore, Chinese OEMs face obstacles in expanding their overall share of the PV market. In the long run, building trust and increasing brand recognition in the ASEAN market will be one of the crucial steps for Chinese OEMs to effectively compete with their Japanese counterparts, and become key players in this growth region.

Methin Changtor, Asia Powertrain Forecast Manager, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center