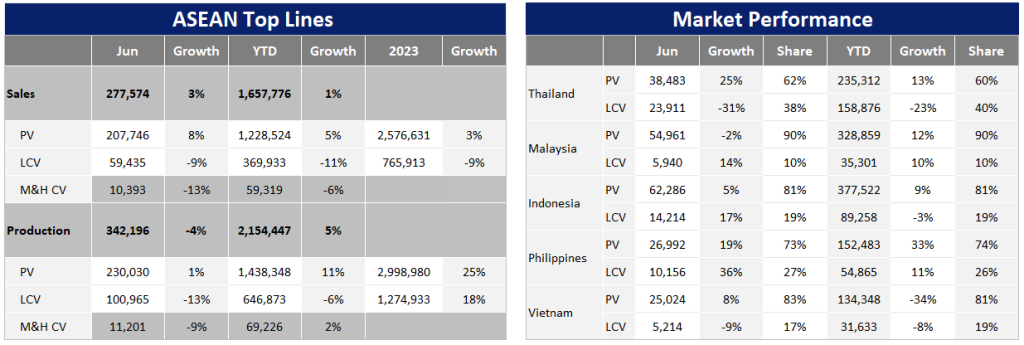

ASEAN Light Vehicle (LV) sales closed the first half of this year with positive growth of 1% YoY. However, the LV market turned from an increase of 3% YoY in the first quarter of this year to a decline of 0.4% YoY in the second quarter of this year. The decline was the result of weak sales performances in Vietnam and Thailand.

Vietnam’s LV sales fell by 28% YoY and 32% YoY in Q1 and Q2 2023, respectively. As such, H1 2023 sales dropped by 30% YoY. This was because a) H1 2022 sales were inflated by the temporary registration fee cut that ended in May 2022, b) higher financing costs and tightened credit conditions, and c) the negative economic outlook. In order to support the auto industry, the government announced the reintroduction of the temporary registration fee reduction (by 50%) for locally produced models from 1 July to 31 December 2023. However, the positive impact of the scheme is expected to be limited, as demand is weak and most consumers who wanted to buy new vehicles probably already did so last year. As such, Vietnam’s 2023 sales were slightly increased from 439k units in our previous report to 443k units in this report.

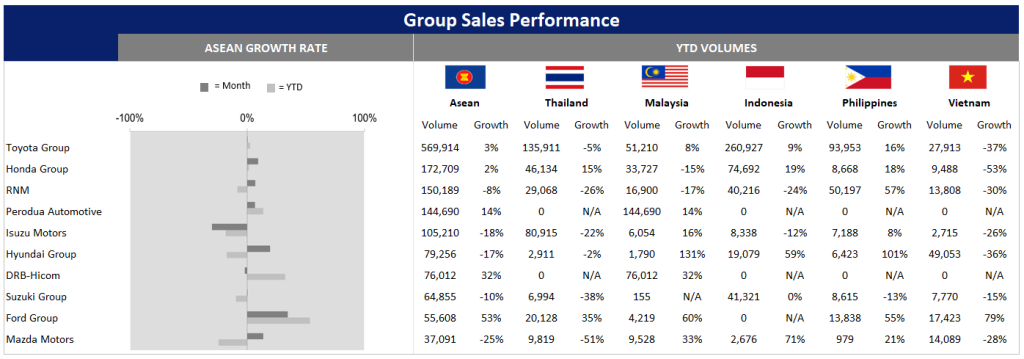

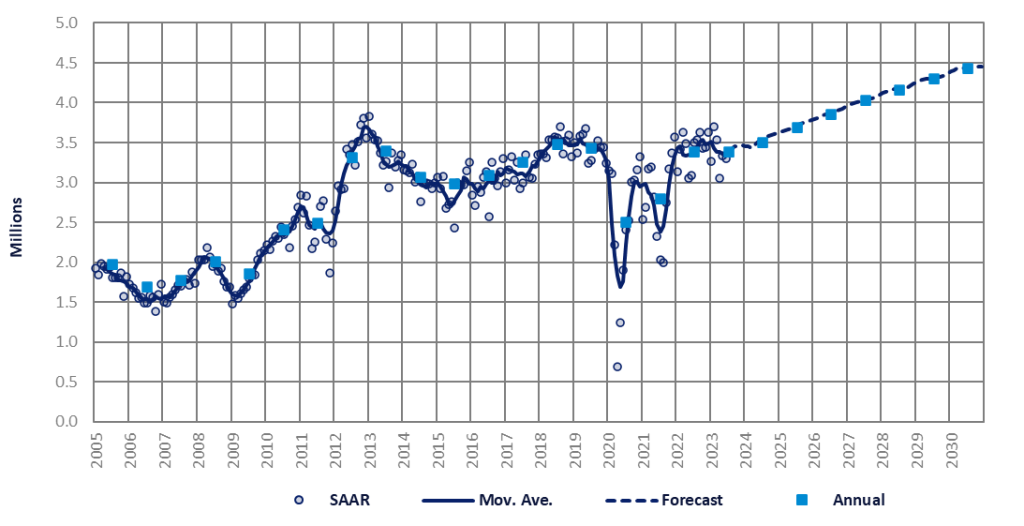

Thailand’s LV sales dropped by 5% YoY in H1 2023, with negative results in Q1 (-6% YoY) and Q2 (-4% YoY). By segment, Passenger Vehicle (PV) sales increased by 13% YoY in H1 2023, thanks to the government’s direct cash subsidy for BEVs, particularly the BYD Atto 3 and Neta V, and strong demand of the new-generation Toyota Yaris Ativ. In contrast, Light Commercial Vehicle (LCV) sales dropped by 23% YoY in H1 2023 since a) an uncertain economic outlook and lingering political uncertainty impacted business investments, including purchases of new commercial vehicles, and b) extreme weather, flooding and drought, could impact rural income and LCV demand. This made us lower Thailand’s LCV sales outlook through the long term. Thus, Thailand’s LV market is now projected at 782k units in 2023 and will not return to 1.0 million units until 2028.

After Malaysian LV demand jumped by 23% YoY in Q1 2023, the market increased only 2% YoY in Q2 2023. However, this marginal increase could be considered a good result since the government completely terminated the temporary tax cut on PVs on 31 March 2023. The positive Q2 2023 sales were driven by carmakers offering competitive prices, aggressive promotions, and value-added services, in order to at least partially offset the end of the tax cut. Also, demand was boosted by the introduction of new models (such as the newly launched Proton X90, the new-generation Perodua Axia, and Toyota Vios), the improved supply, and resilient consumer spending.

Based on Proton’s press release, July sales increased by 29% YoY to 65k units sold. As such, the Malaysian LV market improved by 14% YoY in January–July. Since July sales were stronger than our expectations, we slightly increased the Malaysian 2023 sales outlook to 728k units sold in 2023.

Indonesian LV sales increased by 6% YoY in H1 2023, with 5% and 9% YoY increases in Q1 and Q2 2023, respectively. The positive growth was likely pushed by a) strong demand for new models, in particular the Honda WR-V, Hyundai Stargazer, Toyota Yaris Cross, and newcomer Chery; b) the pre-announcement of LCGC price hikes boosted LCGC sales; and c) production returning to normal and clearing the backlog from last year. Based on our advance data, July sales were around 74k units, or a drop of 3% MoM and 5% YoY. The deceleration was likely due to buyers holding off purchasing and waiting to see the new model launches and sales campaigns at the GAIKINDO Indonesia International Auto Show (GIIAS) event in mid-August. However, July sales were stronger than our expectations. So, we slightly increased the 2023 sales projection to 970k units in this report.

The Philippine market increased by 25% and 28% YoY in Q1 and Q2 2023, respectively. So, YTD sales saw outstanding sales growth of 26% YoY which was supported by the increasing supply, an economic recovery, and strong inflows of remittances from Filipino workers overseas. June sales were stronger than expected, which led us to make minor upward adjustments in the near-term forecasts. Sales are now projected to expand by nearly 15% to 419k units this year, which will be the second-highest sales in the market’s history. For next year, we expect sales growth to decelerate to only 1%, following three consecutive years of double-digit growth.

In conclusion, the ASEAN5 LV 2023 sales outlook was cut from 3.36 million units in our report last month to 3.34 million units in this report. The downward revision for the region was due to the lower Thailand sales forecast, particularly for LCVs.

GlobalData Automotive Forecasts Team