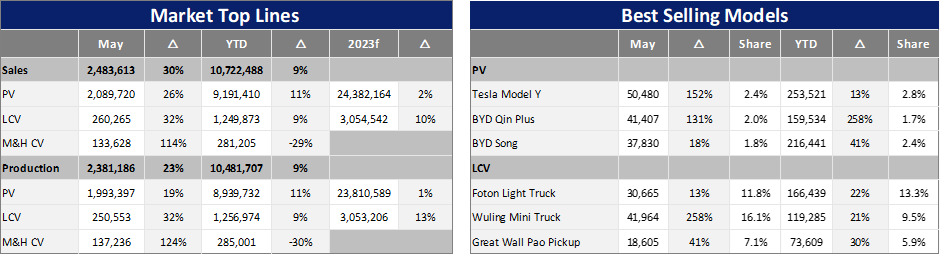

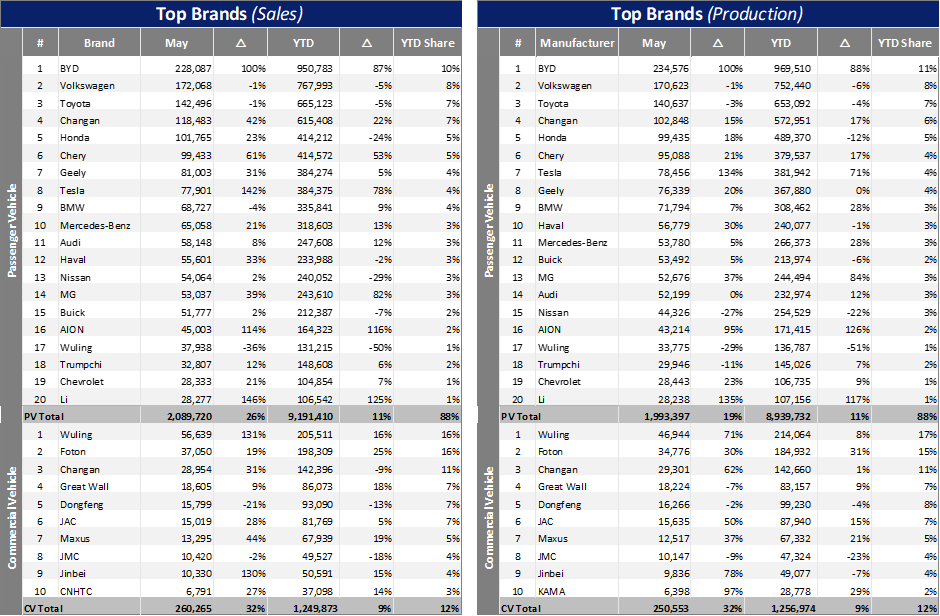

The Chinese market demonstrated a good upward trend in May. Light Vehicle (LV) wholesales came to 2.35 mn units with growth of 27%. At a component level, affected by the pull effect of new energy vehicles (NEVs), total PV wholesale volume reached 2.09 mn units in the month. At the same time, the Light Commercial Vehicle (LCV) sector recovered well, increasing by 32% year-on-year (YoY) to a total of 260k units. On a month-on-month (MoM) basis, PV sales increased by 13%, but LCV sales decreased by 4% in May.

Since the beginning of this year, cumulative LV wholesales have reached 10.44 mn units, an increase of 11%. On the production side, total LV production in May was 2.24 mn units, increasing by 20% YoY and 11% MoM. As the extent of inventory from deferred sales due to the implementation of Stage VI B emissions rules became clear, production has gradually recovered, being driven by underlying market demand. YTD (to May) LV production volume came to 10.19 mn units, increasing by 11%. At the vehicle type level, PV output (87% of total LV production) was 1.99 mn units in May, which was 96K less than the wholesale volume. PV output in May was up by 19% YoY. LCV output was 249k units in May, up 32% YoY and increasing by 9% YTD.

The Chinese market surprised on the upside after posting disappointing results in the first four months of this year. The May selling rate was 29.9 mn units/year, up 15% from a lacklustre April, and the highest rate since September 2022. The YTD selling rate averaged 25.3 mn units/year, which is lower than last year’s total LV sales of 26.7 mn units. Since March, the disruption of the price war on the market has gradually diminished, current market incentivisation is still relatively strong, consumer wait-and-see sentiment has eased, and a large number of new products and low-cost new models have been launched. All of this has resulted in consumer demand being released. Special sales campaigns during the week-long May Day national holiday helped support sales, too.

But interestingly we see that the central government has instructed local governments and financial institutions to introduce subsidies to boost car consumption. This is a clear sign that the government recognises that demand while recovering, is still weaker than expected. Recently, the government finally announced the extension of the temporary purchase tax cut on NEVs (which was originally set to expire in December 2023) until the end of 2027. From January 1, 2024, to December 31, 2025, NEVs will remain exempt from vehicle purchase tax but with a maximum reduction of CNY30,000 (US$4K); From January 1, 2026, to December 31, 2027, the maximum vehicle purchase tax exemption will be halved, with a ceiling of CNY15,000 (US$2K). And this policy is only for vehicles priced below CNY300K. Vehicles priced above CNY300k do not enjoy the preferential policy.

So far in 2023, the central government has not announced any subsidies for conventional fuel cars (ICE). By contrast, the government’s support for the development of NEVs is obvious and the decline of ICE cars in China will accelerate. It should be noted that the structure of the policy of gradual ICE decline over time has increased government influence over the price ceiling of models. While continuing to promote the development of the NEV market and stimulate consumption of new energy products, it has a stronger guiding role in the pricing strategy of manufacturers and hence the choice of which vehicles consumers will buy.

There is no doubt that the electrification of the Chinese car market is still accelerating. NEVs remain the key driver of the market, accounting for 31% of PV sales in the first five months of this year. Sales of BEVs and PHEVs increased by 40% and 97% YTD, respectively. However, their growth has moderated when compared to the triple-digit growth seen last year. To boost new vehicle sales, the government announced the extension of the temporary purchase tax exemption for NEVs as described above. The penetration rate of NEVs (battery electric vehicles and plug-in hybrid vehicles) is expected to reach 34% this year.

On a different metric, the export trend was still strong in May. PV exports reached 320k units in May, increasing by 69% YoY and accounting for 16% of total PV production. Total PV exports YTD 2023 reached 1.44 mn units, an increase of 101% YoY. Chery, SAIC, Tesla, Geely and Great Wall are the leading PV exporters. Among them, Chery Group accounted for the largest portion at 22% of the total. Chery was followed by SAIC with 21% and Tesla with 11%. NEVs form the core of China’s automotive export growth.

Aside from Tesla’s significant exports from China, the brand value of domestic NEV producers has been gradually increasing in the international market. Assuming that political factors don’t negatively influence proceedings, the export volume of Chinese local brands will continue to rise as long as international brands are not able to offer equally competitive products in the same price range.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center