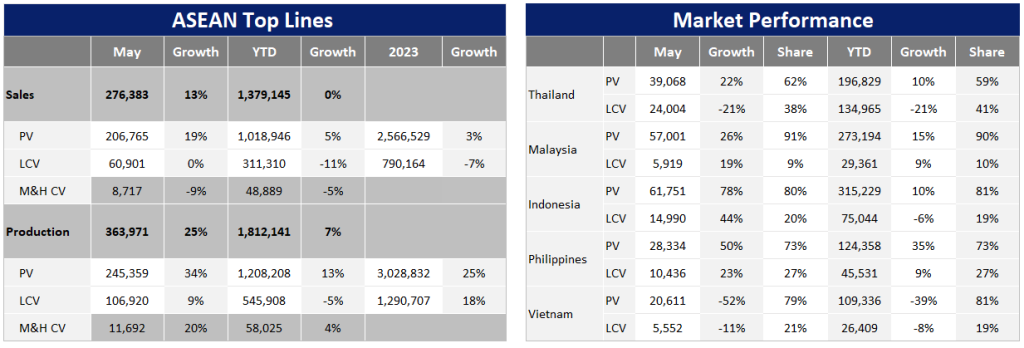

ASEAN Light Vehicle (LV) sales increased by 14% YoY in May 2023 after the market saw a decline in March (-2% YoY) and April (-18% YoY). As such, ASEAN YTD sales turned from a declining of 2% YoY in January – April to the positive territory at 1% YoY in January – May. Briefly, the improvements were largely driven by positive sales growth in Indonesia, Malaysia and Philippines. In contrast, Vietnam LV sales remain weak while the Thai LV market was virtually flat.

The Vietnam market dropped by 47% YoY in May and 35% YoY in January – May. The declining sales performance was due to a) a high-base effect, as 2022 sales were inflated by the temporary registration fee reduction that ended in May 2022, b) higher financing costs and tightened credit conditions and c) the export and manufacturing sectors have decelerated sharply. In order to support the local industry, government announced the re-introduction of the temporary registration fee reduction (by 50%) from July – December 2023. This led us to increase 2023 sales outlook but lower 2024 sales outlook due to the pull ahead effect. Thus, Vietnam’s LV market is now forecast at 439k units in 2023 and 457k units in 2024.

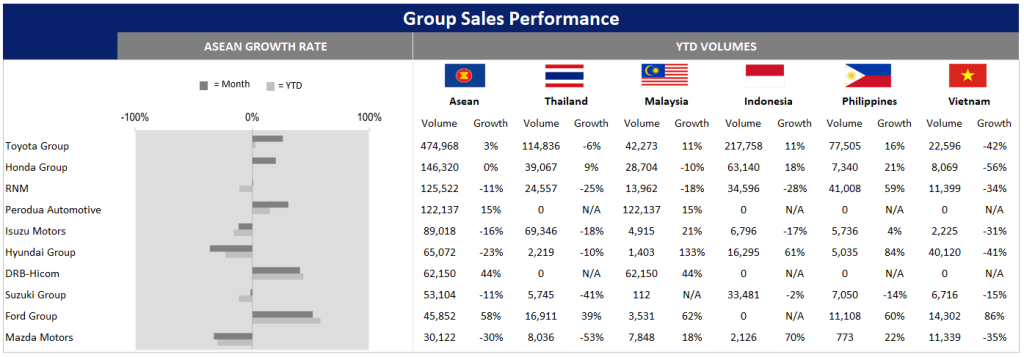

Thailand LV sales marginally increased by 1% YoY in May but fell by 5% YoY in the first five months of this year. In more detail, the Passenger Vehicle (PV) YTD sales rose by 10% YoY thanks to the well received new generation Toyota Yaris Ativ and the strong demand for BEV models, boosted government’s cash subsidy policy. On the other hand, Light Commercial Vehicle (LCV) including Pickup Truck YTD sales plunged by 21% YoY due to a cloudy economic outlook and political uncertainty. Based on our advanced data, Thailand’s June sales were around 63k units or declined by 5% YoY due to poor LCV sales. This led us to cut the LCV sales forecast again and the overall LV market were forecasted at 813k units in 2023. Note that LCV accounted for 49% of Thailand LV sales in 2022 and 41% in January – May 2023.

The Indonesian LV market rose by 70% YoY and 39% MoM in May 2023, after slowing sharply in April due to the end-of-Ramadan holiday. The strong growth in May pushed YTD sales up by 6% YoY. Historically, sales rebound strongly after Ramadan. This year’s rebound, however, was not as strong as expected. That is partially because last year’s temporary tax cut pulled sales ahead. The weaker-than-expected May sales led to minor downward revisions in the near-term forecasts. LV sales are now expected to be flat (+0.8%) at 968k units this year, which is not a bad result, given last year’s pulled-ahead sales.

Malaysia LV demand rose by 25% YoY and 15% YoY in May and January – May, respectively. The outstanding sales performance was because a) consumers rushed to buy new vehicles before the temporary tax cut expired in March 2023 and b) Perodua, market leader, offered to absorb the SST for customers who could not get their vehicles by 31 March while the other company provided some form of compensation (such as free services) for customers instead.

Based on Proton’s press release, Malaysia June sales were estimated at 62k units which equivalent to June last year. That was a good result as the government’s temporary tax cut on PV had already expired. The strong demand led us to increase Malaysia’s sales outlook to a new record high of 724k units this year.

Despite of high vehicle prices and financing rates, Philippines LV sales jumped by 41% YoY in May which was the fifth consecutive month of double-digit growth. As such, YTD sales increased by 27% YoY. The impressive sales result was due to a) the improvement in supply as imported CBU accounted around 80% of the LV market, b) the recovery in economic activity supported LV demand and income and c) continuing solid inflows of remittances from Filipino workers overseas.

For the outlook, Philippines 2023 sales forecast was raised to 413k units due to the strong demand this year and the positive economic indicators. Q1 GDP growth of 6.6% YoY was stronger than expected, thanks to robust investment and private consumption. Headline CPI inflation continued to fall to 5.4% YoY in May from the recent peak of 8.7% YoY in January.

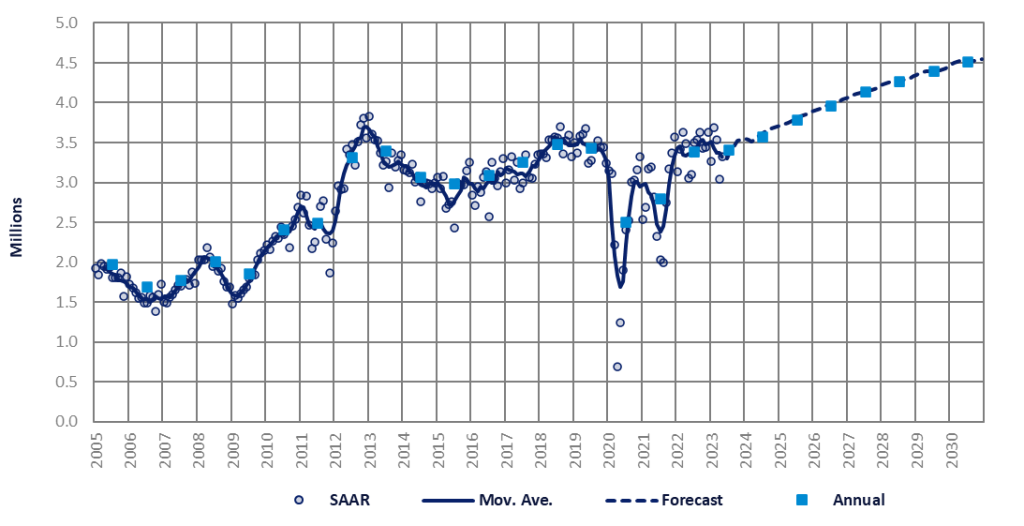

Thus, ASEAN LV 2023 sales remain unchanged at 3.36 million units compared to our previous report with the lower sales outlook for Thailand and Indonesia; and the upgrade in sales outlook for Vietnam, Malaysia and Philippines.