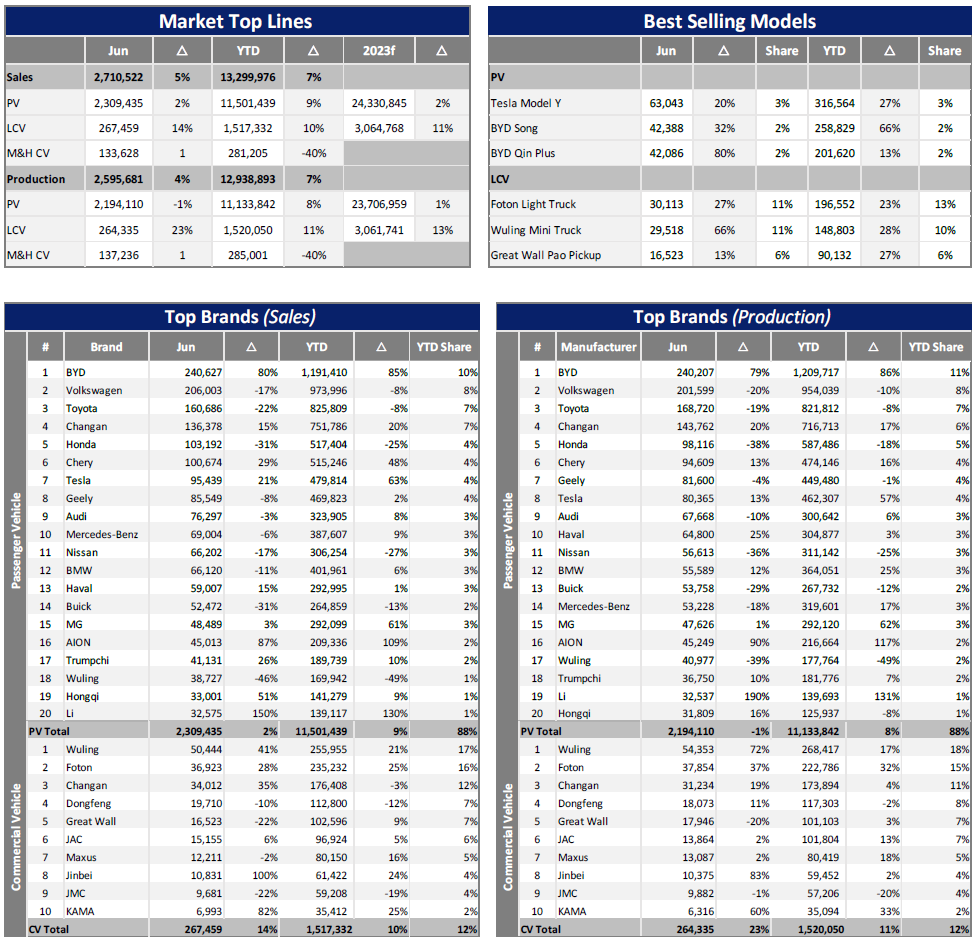

The Chinese market accelerated strongly in June. Light Vehicle (LV) wholesales came to 2.58 million units with growth of 3%. At segment level, total PV wholesale volume reached 2.31 million units with growth of 2% in the month. At the same time, the Light Commercial Vehicle (LCV) sector recovered well, increasing by 14% year-on-year (YoY) to a total of 267k units. On a month-on-month (MoM) basis, PV sales increased by 11%, and LCV sales also increased by 3% in June.

Since the beginning of this year, cumulative LV wholesales have reached 13.02 million units, an increase of 3%. On the production side, the total LV build in June was 2.46 million units, increasing by 1% YoY and 10% MoM. At the vehicle type level, PV output (89% of total LV production) was 2.19 million units in June, which was 115K less than the wholesale volume. But PV output in June was down by 1% YoY which was the first fall seen so far in 2023.

LCV output was 263k units in June, up 23% YoY and increasing by 11% YTD. As the extent of inventory from deferred sales due to the implementation of Stage VI B emissions rules became clear, production has gradually recovered, being driven by underlying market demand. YTD (to June) LV production volume came to 12.65 million units, increasing by 9%.

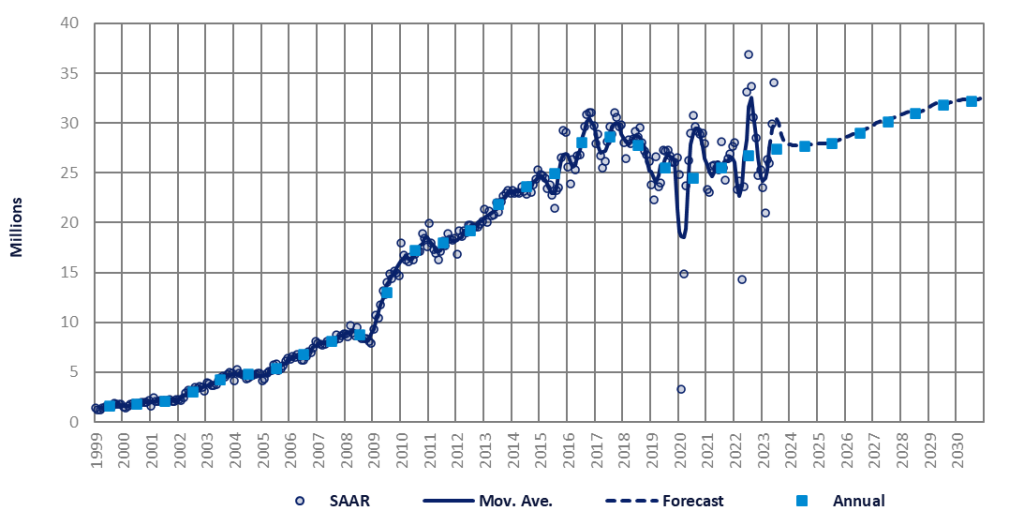

The June selling rate spiked to 33.4 million units/year, up nearly 12% from a robust May, and the highest rate since August 2022. That brought the YTD average selling rate to 26.8 million units/year, on a par with last year’s total LV sales of 26.7 million units. In YoY terms, however, sales (i.e., wholesales, which include exports) were virtually flat (+0.9%) in June (due partially to a high base) and increased by 8.7% in H1 2023.

Since March, the disruption of the price war on the market has gradually diminished, current market incentivisation is still relatively strong, consumer wait-and-see sentiment has eased, and a large number of new products and low-cost new models have been launched. All of this has resulted in consumer demand being released. Special sales campaigns during the week-long May Day national holiday helped support sales, too. But interestingly we see that the central government has instructed local governments and financial institutions to introduce subsidies to boost car consumption.

This is a clear sign that the government recognises that demand, while recovering, is still weaker than expected. Recently, the government finally announced the extension of the temporary purchase tax cut on NEVs (which was originally set to expire in December 2023) until the end of 2027. From January 1, 2024, to December 31, 2025, NEVs will remain exempt from vehicle purchase tax but with a maximum reduction of CNY30,000 (US$4K); From January 1, 2026, to December 31, 2027, the maximum vehicle purchase tax exemption will be halved, with a ceiling of CNY15,000 (US$2K). And this policy is only for vehicles priced below CNY300K. Vehicles priced above CNY300k do not enjoy the preferential

So far in 2023, the central government has not announced any subsidies for conventional fuel cars (ICE). By contrast, the government’s support for the development of NEVs is obvious and the decline of ICE cars in China will accelerate. It should be noted that the structure of the policy of gradual ICE decline over time has increased government influence over the price ceiling of models. While continuing to promote the development of the NEV market and stimulate consumption of new energy products, it has a stronger guiding role in the pricing strategy of manufacturers and hence the choice of which vehicles consumers will buy.

NEVs remain the market driver. In H1 2023, NEV sales expanded by 44% YoY and accounted for almost a third of PV sales. Among PV wholesales (which include exports), the three best-selling models were the Tesla Model Y, the BYD Qin Plus and Song Plus – all NEVs. (Note, about half of Tesla wholesales were for export.) However, NEV sales growth has moderated, compared to the triple-digit percent expansion seen last year. In H1, Chinese NEV brands continued to advance, with their sales surging strongly. In contrast, sales of non-Chinese brands (the traditional ICE makers, such as VW, Toyota and Honda) recorded YoY declines.

According to preliminary reports, exceptionally strong June wholesales were boosted by rapidly expanding exports (especially to Russia and exports of NEVs). Exports accounted for about 14% of June Passenger Vehicle sales, while domestic sales were sluggish. PV exports reached 304k units in June, increasing by 59% YoY. Total PV exports YTD 2023 reached 1.75 million units, an increase of 93% YoY. Chery, SAIC, Tesla, Geely and Great Wall are the leading PV exporters. Among them, Chery Group accounted for the largest portion at 23% of the total. Chery was followed by SAIC with 21% and Tesla with 11%. NEVs form the core of China’s automotive export growth.

In general, this month, due to the new emission standards that will be implemented on 1 July, OEMs have a clear trend of destocking and are cautious about production. In the first half of the year, affected by the price war and various policy uncertainties, the market wait-and-see sentiment was strong. In June, with the announcement of the NEV purchase tax exemption policy and the implementation of the state emission VI B standards, underlying consumer demand was released.