Despite stuttering production and the threat of weakening demand faced by automakers in Brazil, Chinese automakers are making strides in establishing localized production of their offerings in the region.

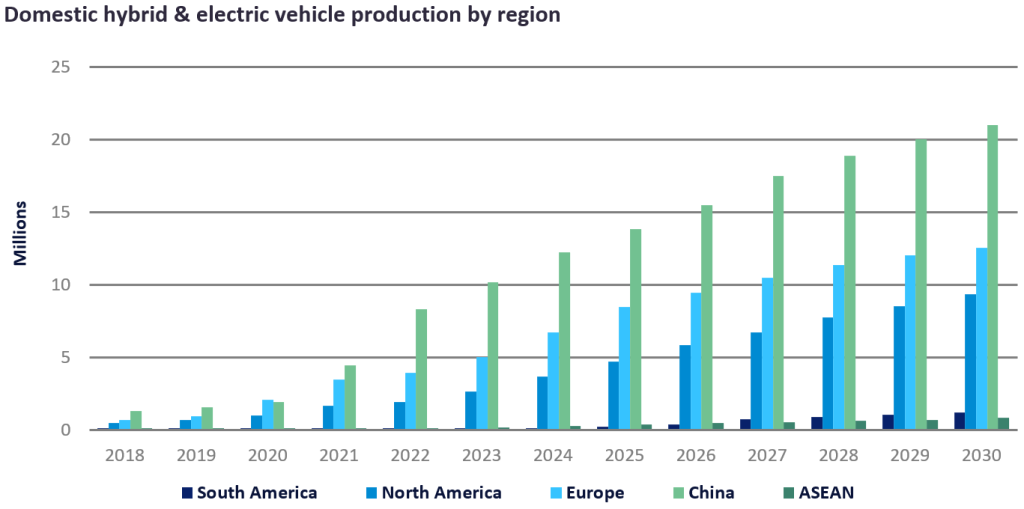

With the announcements of Great Wall Motor (GWM) and BYD Auto’s planned arrivals, the race is on to see which group can bring localized production of electrified Light Vehicles (LVs) before other players. Although production of electrified models has gradually been on the rise globally, the region is just beginning to open to the production of these models, with Brazil at the forefront. The optimistic goals from GWM and BYD have shaken up the region as the groups fight to establish production in the region sooner than the other, also pushing long-standing automakers to make moves of their own.

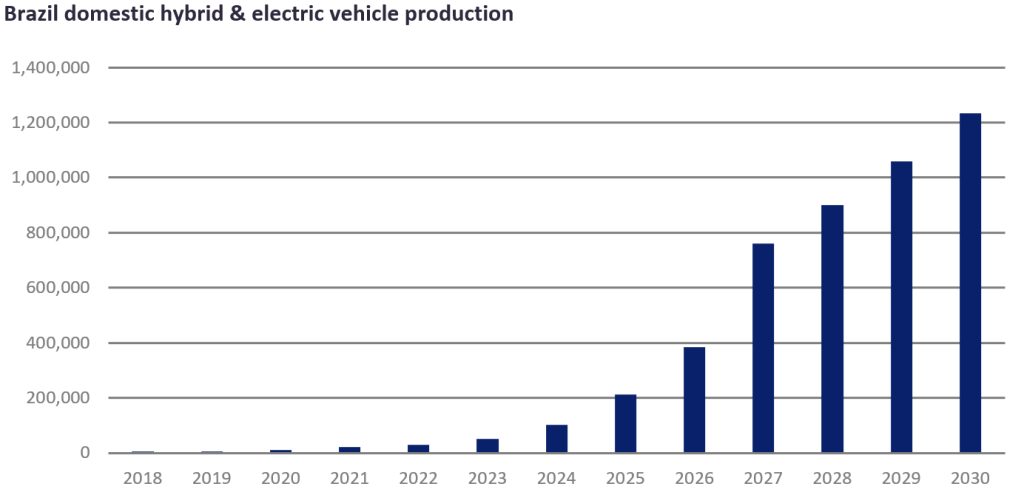

Using the strategy of acquiring previously owned plants, GWM and BYD have a lot of optimism in offering all-electric and hybrid vehicles to compete with the likes of Toyota’s Corolla and Corolla Cross. These Toyota models have historically made up most of the localized production of hybrid offerings in the country, until Chery introduced its mild hybrid versions of the Tiggo 5x and Tiggo 7 lines in 2022. Moving through the forecast period, we expect to slowly see additional hybrid versions of popular models sprouting up, reaching over 1 million units by 2030.

GWM hopes to produce all-electric and hybrid models in Brazil with 10 models anticipated to be launched in the next three years. It is expected that production will begin with the Great Wall Poer Midsize Pickup, followed by two SUV offerings: the Haval H6 and the Haval Jolion. The automaker’s initial goal was to begin production in 2023 at the plant previously operated by Mercedes-Benz in Iracemápolis, but this has already been pushed out to 2024. The Iracemápolis plant currently has a 20k unit capacity, which the OEM intends to increase to 100K annually over the next three to five years through a series of investments.

BYD is following the same strategy of acquiring a previously owned plant in Brazil, in this case Ford’s Camaçari plant, to establish localized production of its plug-in hybrids and electric vehicles. The process of purchasing the plant began back in 2022, and more developments are expected following recent news of an agreement being reached between the automaker, the State of Bahia and Ford. It is anticipated that production at Camaçari under BYD will begin at the start of 2025, kicking off with production of the Song Plus plug-in hybrid, with the hope of reaching 30k units of capacity in the first year and the intent to expand production to 150k units in the future. We also see the Dolphin Small Hatchback EV being brought into production and anticipate further announcements as it is likely additional models will be added to local production.

The gradual adoption of hybrids and EVs globally has been in the process for some time with unsurprising delays, and a similar story will likely play out in South America with added complexities. Despite the hopefulness shared by GWM and BYD, the region has its own risk of potential delays due to the current lack of infrastructure, demand, and the usage of ethanol as a gasoline alternative. In the region, Volkswagen has already faced delays to its anticipated MQB-A0 platform launch for hybridization which was initially expected to occur in 2024 but has been pushed out to 2025. With recent news of Stellantis’ anticipated 2024 launch of their new bio-hybrid platforms designed for electrification in South America, it is likely more automakers will join the race sooner than anticipated in hope of success in the region.

More announcements are guaranteed to come as the Chinese automakers push the region to catch up with adoption of localized production of electrified models, but only time will tell which automaker will triumph.

Emily Vihonsky, Analyst, Americas Vehicle Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center