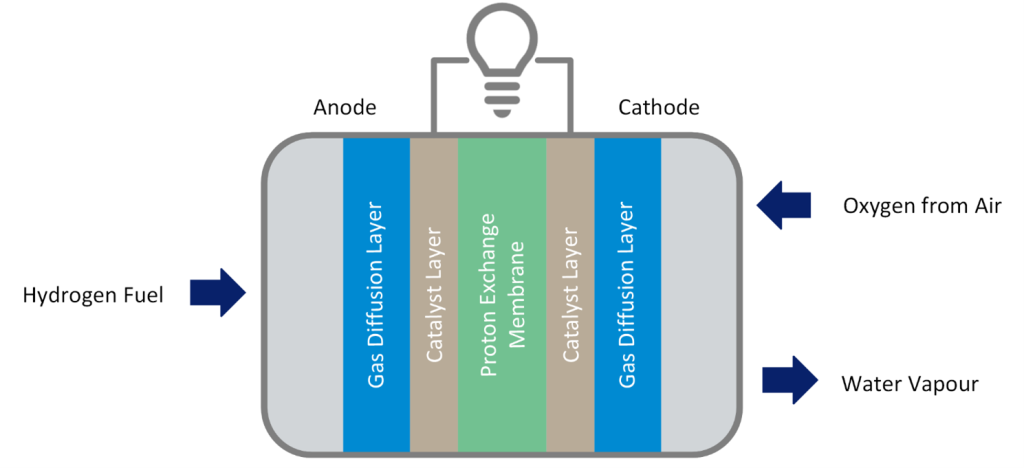

Fuel cells are one of several high-profile technologies available for passenger vehicle decarbonisation. When applied to the field of personal mobility, a proton exchange membrane fuel cell (PEMFC) is implied. PEMFC is favourable in auto applications because it has a low operating temperature and a high energy density.

The typical PEMFC in use today contains four key components including a proton conducting membrane, gas diffusion layer, cathode, and anode with embedded platinum-based catalyst. In brief, the hydrogen feedstock reacts with oxygen from the air to generate electricity. The only reaction product is water which is produced on the cathode side and exhausted from the system.

In an automotive application, FCEVs take only around three minutes to refuel which is particularly important for commercial vehicles like taxis and buses. Moreover, hydrogen is a high energy carrier when compared with even state-of-the-art lithium solid-state batteries (33.4 kWh/kg vs 0.4 kWh/kg). In other words, a fuel cell vehicle can travel much further without refuelling, which gives it an advantage in long-haul vehicles. The energy contained in hydrogen does not diminish over time and distance travelled. FCEV can be a zero-emission solution that is used where BEV is not a feasible option, for instance, in areas without electric grid coverage.

A clean and energy-dense power source makes fuel cell vehicles sound like a dream. So, why have they not gained popularity in the real world? There is no doubt that FCEV outperforms BEV in many ways. However, we foresee that FCEV will not be a popular choice in the next ten years. Meanwhile, BEVs are dominating the global PV zero emission vehicle (ZEV) market. We summarise the key reasons for this:

Technology constraints

It is widely agreed that catalyst degradation is the key limitation of the life of a fuel cell. The platinum-based catalyst used in FCEVs is relatively fragile. The active material dissociates and changes in microstructure during operation. Moreover, platinum is sensitive to impurities in hydrogen fuel, like carbon monoxide which is a product of steam reforming for hydrogen production from natural gas (the source of most hydrogen). All these factors could add up to an unsatisfactory performance. Much effort has been put into developing new types of catalysts for a longer lifespan, like new chemistries and structures. However, most of them are still at an early stage and may take years to be adopted into commercial products.

Lifespan concerns

The U.S. Department of Energy has had a target of 5,000 hours for fuel cell stack life since 2015. This is approximately 150,000 miles of driving. Unlike other fuel types, there is not sufficient data to predict the life expectancy of FCEVs which is a headwind for the technology. Fortunately, an approximate lifespan can be predicted based on the manufacturer’s warranty. Toyota, for instance, provides a 60,000-mile (100,000 km) warranty for its FCEV MIRAI model. In contrast, most BEV manufacturers provide a warranty that covers 100,000 miles (160,000 km) or even longer. Thus, it is sensible to expect that BEVs will last significantly longer than FCEVs.

Lack of infrastructure

According to data from the European Alternative Fuels Observatory (EAFO), there are 14 hydrogen refuelling stations in the UK and 136 across EU member states. The number is exceptionally low and not all stations are accessible to the public for passenger cars. In contrast, there are over 430,000 plug-in charging points across the EU. This is not to mention that many BEV owners will have a home charger installed in their home or workplace. Although the BEV charging space remains far from complete in many parts of the world, customers show more confidence in BEV than FCEV primarily due to the difficulty in the refuelling of the latter.

High capital and operating costs

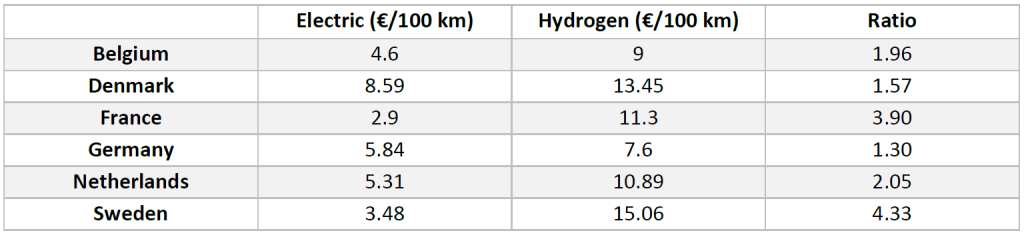

There are very few hydrogen-powered passenger cars available in the European market. Currently, the Hyundai Nexo and Toyota MIRAI are the dominant models. They sell in a price range between €65,000 to €70,000 which is higher than the average BEV price of €56,000 in 2022. But vehicle prices may not be the only reason for low FCEV sales. In addition, the running costs of an FCEV may help explain the poor take-up. EAFO summarises the fuel price to operate a BEV and an FCEV in the following table. It shows that consumers need to pay 1.3 to 4.33 times more to operate an FCEV than a BEV. Simply put, BEV is a more cost-efficient choice for most passenger car customers.

Lack of incentives

Government incentives are crucial in supporting the adoption of innovative technologies. Most European Union members provide incentives for purchasing FCEVs that help offset the high acquisition cost compared with other fuel types. However, there are insufficient incentives for the hydrogen production and delivery infrastructure. More specifically, incentives for hydrogen production are exclusive to green hydrogen (hydrogen produced using renewable electricity). Also, there is limited discussion on affordable hydrogen distribution. The time required to build vehicle fuelling infrastructure, especially for FCEVs, is lengthy and the cost involved is large. Even if investment were forthcoming, the timescale for Europe to have a mature foundation for FCEV operation could be far longer than anticipated.

On the bright side, we do see some effort in making FCEVs more attractive globally in the passenger car segment. For example, a new iron-based catalyst has been developed to replace expensive platinum catalysts, hopefully bringing down the fuel cell price. In addition, FCEVs were the major transportation type at the Beijing Winter Olympics. This exercise showed that, with adequate government support, FCEV has the potential to be widely used. However, our existing technologies and infrastructures are not yet ready to embrace FCEV. Therefore, unless there is a huge technology breakthrough, we are not optimistic about FCEV adoption in passenger car sales during the next decade.

Chun Fung Lee, Powertrain Analyst, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center