Each week, Just Auto’s editors select a deal that illustrates the themes driving change in our sector. It may not always be the largest deal in value, or the highest profile, but it will tell us where the leading companies are focusing their efforts, and why.

Our thematic deal coverage is driven by our underlying disruptor data which tracks all major deals across our sectors.

Today, it’s the spin-off by BorgWarner of its fuel systems and aftermarket business.

The deal

In December 2022, BorgWarner announced its intent to spin-off the Fuel Systems and Aftermarket segments (later named Phinia), consistent with its Charging Forward strategy.

BorgWarner has announced that it expects to complete the spin-off of Phinia – its fuel systems and aftermarket business – at the end of the day on July 3, 2023, as outlined in Phinia’s final information statement filing with the Securities and Exchange Commission.

Phinia common stock will be traded on the New York Stock Exchange under the ticker symbol PHIN.

The first day of trading is expected to be Wednesday, July 5, 2023.

Why it matters

Supply chains in the automotive sector are starting to adjust for the energy transition – and big rise in electrification of vehicle markets – that is looming. Suppliers – especially the larger Tier 1s (such as BorgWarner) are critically evaluating their product offerings and manufacturing footprints. They want to be viewed early on – ahead of the curve – by their OEM suppliers as key technology partners for future yet-to-be-fully-formulated supply chains.

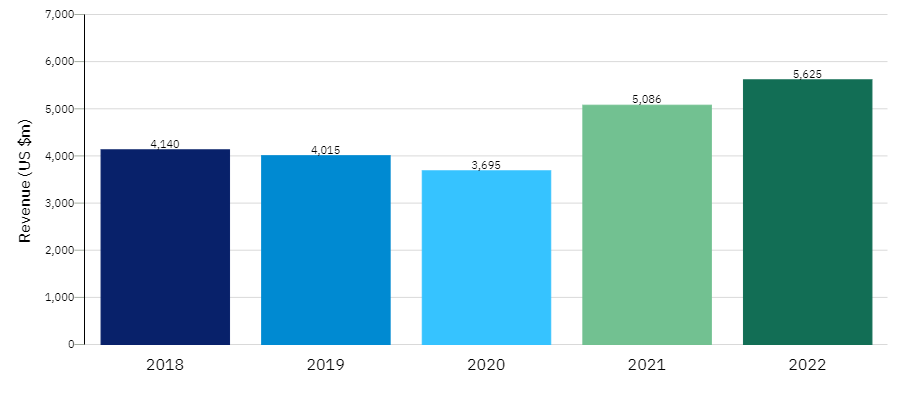

BorgWarner is among the auto industry’s Tier 1 suppliers taking actions for this big strategic shift – including divesting some parts of its business, such as the fuel systems and aftermarket business that will be spun-off as Phinia. It is a significant piece in the evolution of the strategy after it acquired Delphi Technologies in 2020.

BorgWarner announced its ‘Charging Forward’ strategy in March 2021 and has made significant progress in achieving its targets and pivoting its strategic direction towards e-mobility.

The company says it is on track to have at least 25% of its revenues from battery electric vehicles (EV) by 2025, with organic EV bookings of $3 billion for 2025 exceeding its $2.5 billion target.

Additionally, EV-focused M&A is tracking ahead of plan with the five acquisitions the company has made in the battery pack, e-motor, power electronics, and direct current fast charging spaces.

Earlier this year, BorgWarner acquired Rhombus Energy Solution, which expands BorgWarner’s electric vehicle portfolio in North America and complements its existing European charging business. It also acquired Tianjin Santroll Electric Automobile Technology Co., Ltd., a China-based manufacturer and seller of solutions and components for electric vehicles.

Just this week, the company announced the acquisition of Eldor’s electric hybrid systems business.

GlobalData analysis also highlights the dynamic environment for M&A activity in automotive. GlobalData analyst Al Bedwell points out: “We’re seeing companies divesting or investing where they can, looking to specialize and competitively position themselves for future profitability.

“There are a lot of unknowns in terms of precise future powertrain mix and some emerging technologies – such as hydrogen – and companies have to take tough decisions on where to make their investments and concentrate their resources.

“Furthermore, the supply chains in electrification – take batteries for example – are still being formed and that process will go on for many years.”

See also: BorgWarner – company profile