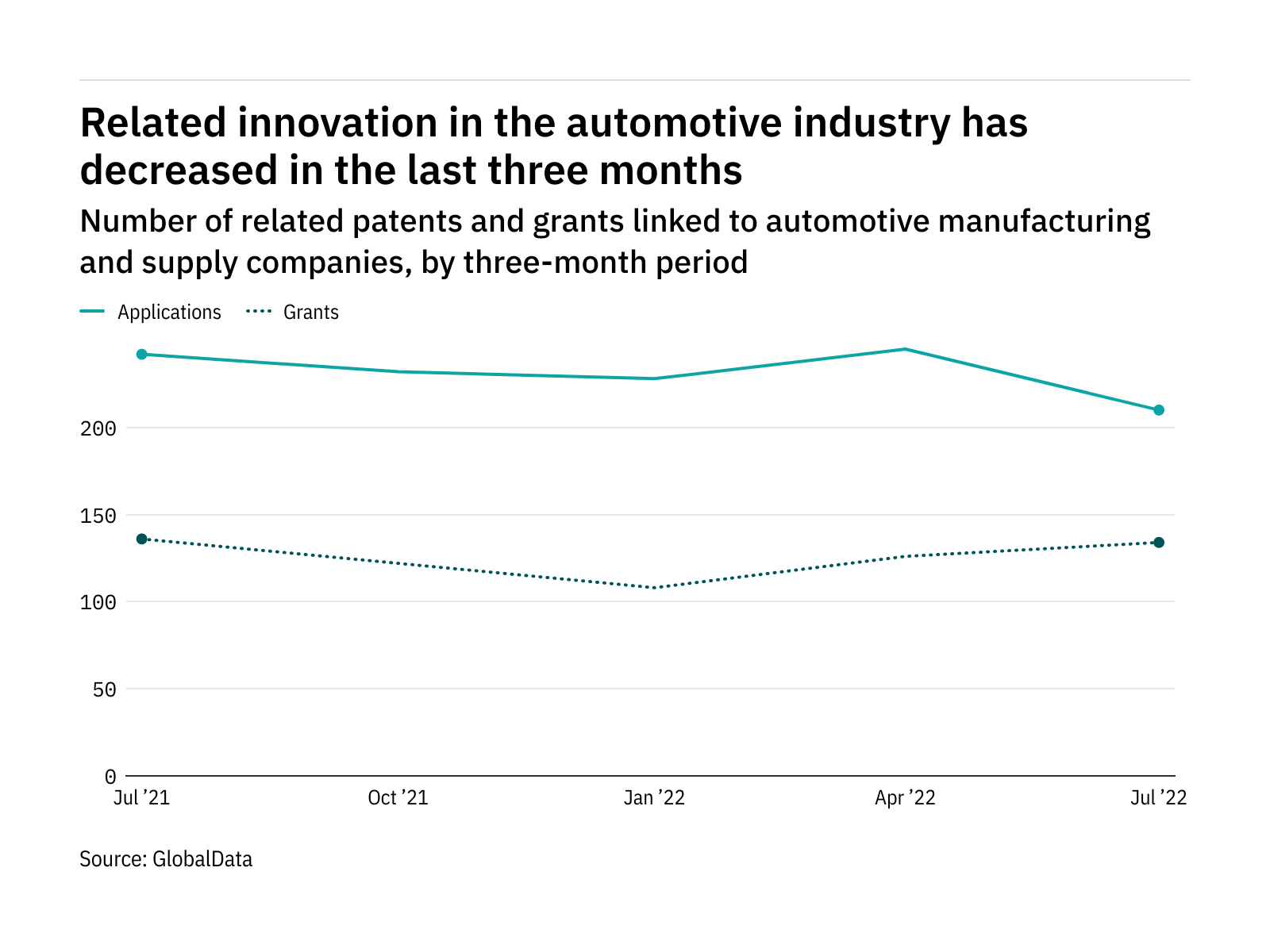

Research and innovation in cybersecurity in the automotive manufacturing and supply sector has declined in the last year.

The most recent figures show that the number of related patent applications in the industry stood at 210 in the three months ending July – down from 242 over the same period in 2021.

Figures for patent grants related to followed a similar pattern to filings – shrinking from 136 in the three months ending July 2021 to 134 in the same period in 2022.

The figures are compiled by GlobalData, who track patent filings and grants from official offices around the world. Using textual analysis, as well as official patent classifications, these patents are grouped into key thematic areas, and linked to key companies across various industries.

is one of the key areas tracked by GlobalData. It has been identified as being a key disruptive force facing companies in the coming years, and is one of the areas that companies investing resources in now are expected to reap rewards from.

The figures also provide an insight into the largest innovators in the sector.

Toyota Motor Corp was the top innovator in the automotive manufacturing and supply sector in the latest quarter. The company, which has its headquarters in Japan, filed 46 related patents in the three months ending July. That was up from 44 over the same period in 2021.

It was followed by the United States based Ford Motor Co with 24 patent applications, Germany based Porsche Automobil Holding SE (22 applications), and China based Chongqing Changan Automobile Co Ltd (17 applications).

Chongqing Changan Automobile Co Ltd has recently ramped up R&D in . It saw growth of 76.5% in related patent applications in the three months ending July compared to the same period in 2021 - the highest percentage growth out of all companies tracked with more than 10 quarterly patents in the automotive manufacturing and supply sector.