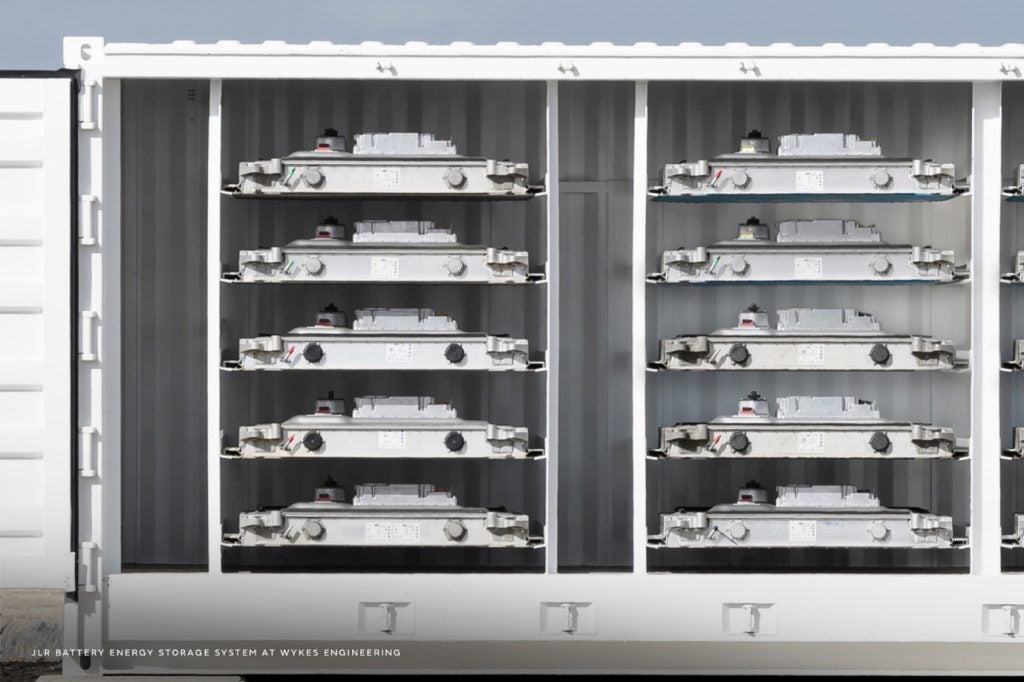

Analysis of the key themes driving private equity deal activity reveals that energy transition accounted for 6 automotive deals announced in Q2 2023, worth a total value of $1.1bn. The $944m investment by MBK Consortium and SNB Capital in SK on Co was the industry’s largest disclosed deal. GlobalData’s Automotive Industry Mergers and Acquisitions Deals by Top Themes – Thematic Intelligence report helps understand the themes that impact the automotive industry by analyzing which themes drive the M&A activity. Buy the report here.

In value terms, energy transition-related deal activity decreased by 93% in Q2 2023 compared with the previous quarter’s total of $16.5bn and rose by 384% as compared to Q2 2022. Related deal volume decreased by 14% in Q2 2023 versus the previous quarter and was 100% higher than in Q2 2022.

The top-ranked legal advisors supporting these private equity deals in Q2 2023 were White & Case; Cameron Barney; Fladgate with 2, 1, 1 deals respectively.

For further understanding of GlobalData's Automotive Industry Mergers and Acquisitions Deals by Top Themes in 2022 - Thematic Intelligence, buy the report here.