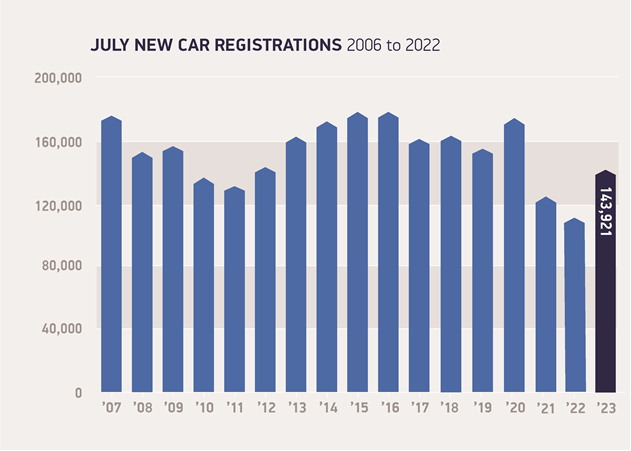

The UK new car market grew 28.3% year-on-year in July with 143,921 new vehicles registered, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

July was the best July performance since 2020, when pent-up demand for new cars was unleashed following three months of lockdown during the pandemic. Despite this continuous growth, however, the overall market year to date remains behind pre-pandemic levels.

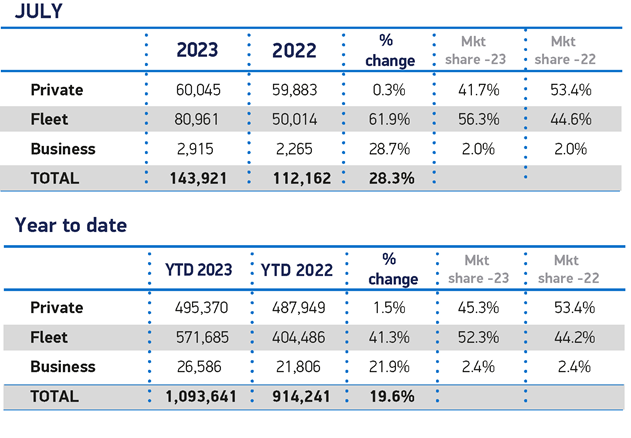

Company (fleet) registrations drove the growth, as uptake by large fleets increased 61.9% to 80,961 units and business registrations rose 28.7% to 2,915 new vehicles. Private demand remained stable at 60,045 units (up 0.3%).

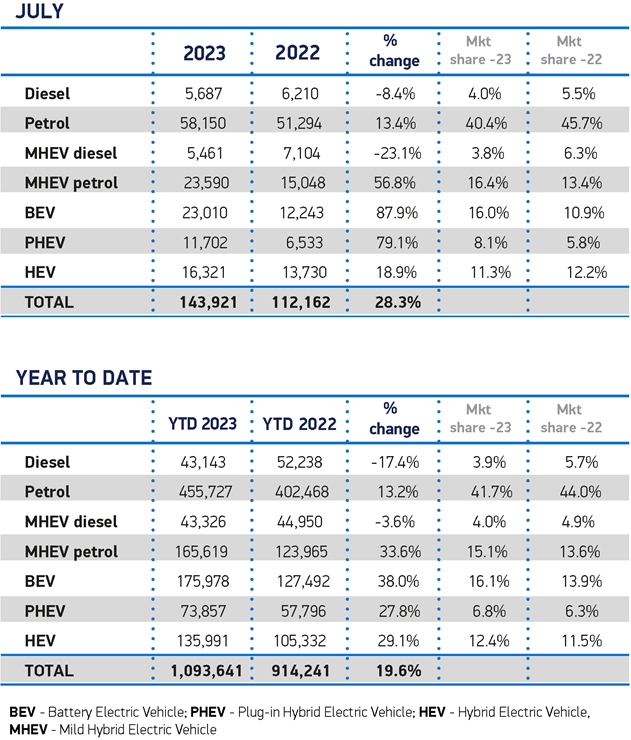

Electrified vehicles accounted for more than a third (35.4% of the market). Hybrid (HEV) volumes grew, although their overall market share fell to 11.3%. Plug-in hybrid (PHEV) registrations saw a significant uplift for the second month in a row as uptake rose 79.1% to account for 8.1% of the market. The biggest increase, however, was for battery electric vehicles (BEVs), which recorded an 87.9% increase to account for 16.0% of all new registrations for the month, a market share broadly consistent with that seen so far this year.

Mike Hawes, SMMT Chief Executive, said: “The industry remains committed to meeting the UK’s zero emission deadlines and continues to make the investments to get us there. Choice and innovation in the market are growing, so it’s encouraging to see more people switching on to the benefits of driving electric. With inflation, rising costs of living and a zero emission vehicle mandate that will dictate the market coming next year, however, consumers must be given every possible incentive to buy. Government must pull every lever, therefore, to make buying, running and, especially, charging an EV affordable and practical for every driver in every part of the country.”

Stock levels recovering

Richard Peberdy, UK Head of Automotive for KPMG, pointed out that fleet sales are driving the market as stock levels recover. “New car demand remains healthy, particularly considering the higher cost of living and increased cost to car finance,” he said.

“That higher cost is causing some consumers to have to reassess brands and models and trade down, but overall consumer car sales levels so far this year are up on last – with both electric and hybrids growing market share.

“The major growth in the market though is being driven by fleet and business vehicle purchases, who previously found stock hard to come by due to pandemic supply disruption. Electric vehicles are a key part of this business buying growth – aided by low benefit-in-kind tax and write-down allowances.”