Summary

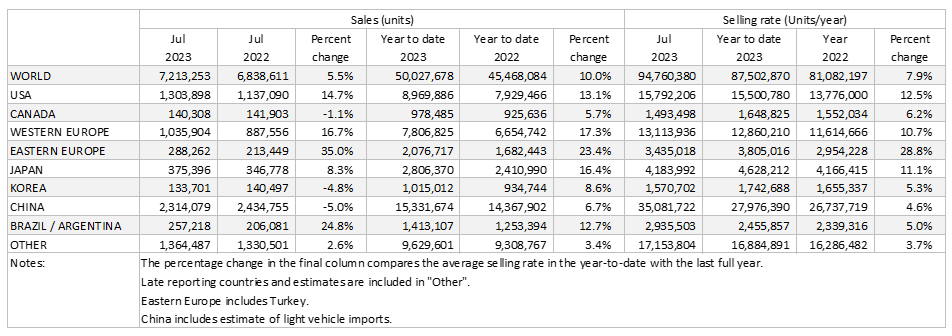

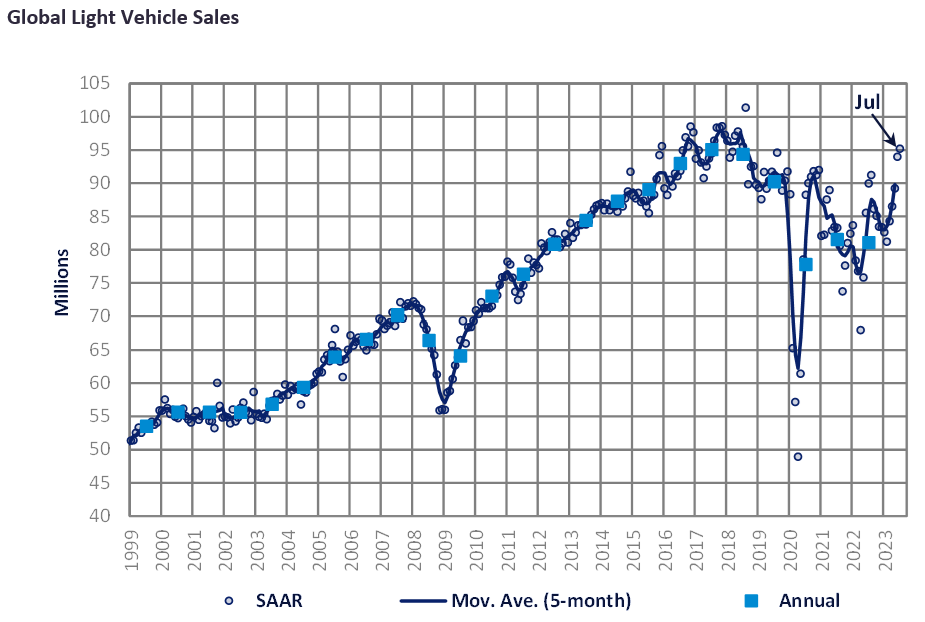

- The Global Light Vehicle (LV) selling rate rose for the fifth consecutive month in July, reaching 95 million units/year from a revised figure of 94 million units/year in June. Despite continued year-on-year (YoY) growth, global LV sales for July recorded a moderate 5.5% YoY increase following a run of stronger growth over previous months.

- While the USA, Western and Eastern Europe all registered double digit YoY growth in July, China and Korea both experienced YoY declines. For both countries, the decline in performance was largely due to comparatively strong levels in 2022, as well as the expected additional excise duty finally being implemented in Korea. With reduced consumer spending in China, several automotive firms have slashed prices to help stimulate demand in the region.

Commentary

North America

The US Light Vehicle market continued to show strong levels in July, as sales increased by 14.7% YoY, achieving 1.3 million units. The selling rate increased only slightly, standing at 15.8 million units/year in July. The average transaction price decreased heavily in July, falling by US$792 month-on-month (MoM), to US$45,437. This was partly caused by dealers offering more generous incentives, which increased by a significant margin in July, to US$1,902, up by US$166 MoM. In addition, the mix of vehicles sold contained a higher proportion of more affordable models than has typically been the case recently.

In July, Canadian LV sales reached 140.3k units, decreasing by 1.1% YoY. As sales declined from the previous month, the selling rate also decreased in July, to 1.5 million units/year, from 1.7 million units/year in June. Light Vehicle sales in Mexico grew by 33.5% YoY to 110.3k units in July. As sales continue to defy expectations, the selling rate remained at pre-pandemic levels in July, at 1.4 million units/year.

Europe

The West European LV selling rate in July grew slightly to 13.1 million units/year, despite a drop in the raw monthly registration figure to near 1 m units (+16.7% YoY). The stronger selling rate was aided by strong performances in both the UK and Italy. The region’s market continues to benefit from an improvement in supply constraints and higher delivery rates for consumers. Year-to-date (YTD), the region has recorded 7.8 million units (+17.3% YoY).

The East European LV selling rate fell to 3.4 million units/year with the raw monthly registration figure of 288k units (+35% YoY). The strong YoY growth was supported by Russia selling almost 70k units in July, which is 93% higher than the same period last year. While the YTD figure for the region (2.1 million units) is up 23.4% YoY, it is down 9% from pre-pandemic 2019 levels.

China

According to preliminary data, the Chinese market remained surprisingly robust. The July selling rate reached 35.1 million units/year, the second highest rate on record, following the abnormally strong post-lockdown rate in July 2022. In YoY terms, sales (i.e., wholesales, which include exports) declined by 5%, but that was due to the abnormally high sales figures a year-ago. In the first seven months of this year, the selling rate averaged 28 million units/year and deliveries to dealerships increased by 6.7%.

Note, however, it was exports that continued to support wholesales. Exports accounted for about 16% of wholesales in July, expanding by 35% YoY. NEV sales (which include exports) increased by nearly 32% YoY, but their growth has been slowing. Domestic sales remained sluggish, as consumers are wary about a flagging economy and a prolonged deep slump in the property market. Major OEMs, such as VW and GM, launched a fresh round of price cuts.

Other Asia

The Japanese market slowed for the third straight month. The July selling rate was 4.2 million units/year, down almost 5% from June, and a substantial slowdown, compared to an exceptionally high 4.8 million units/year in May. July sales were dragged down by extreme heat waves across the country and weak Mini Vehicle sales (which account for about 40% of total Light Vehicle sales) due to parts shortages caused by fire at a supplier. Demand, however, remains robust, thanks to strong wage growth.

As expected, sales in Korea slowed sharply in July, as the temporary excise tax reduction on Passenger Vehicles expired at the end of June. The changes in the tax structure on 1st July resulted in lower taxes for domestic models, but without the tax change, sales could have been weaker. A long period of heavy rains was another drag. The July selling rate was 1.6 million units/year, down nearly 13% from a strong 1.8 million units/year in June. In YoY terms, sales declined by about 5% in July.

South America

Preliminary estimates indicate that Brazilian LV sales increased by 27.1% YoY in July to 215.7k units. This is the first time that sales have exceeded 200k units since December 2022. The selling rate also increased dramatically, from 2.1 million units/year in June to 2.5 million units/year in July. The government incentive scheme offering discounts up to R$8,000 on some vehicles provided a clear boost to sales, although the effect was not as strong as expected, suggesting underlying demand remains weak.

In Argentina, LV sales are estimated to have grown to 41.5k units in July, up by 14.2% YoY. The selling rate also increased from 452.5k units/year reported in June, to 474.3k units/year in July. This is the fifth consecutive month in which the selling rate has exceeded the 400k units/year mark, as the market appears to have returned to pre-pandemic levels, although it is still well below historical peaks.