May Sales were in line with expectations

The Indian market maintained its robust momentum in May, as Light Vehicle (LV) wholesales inched up by 2% from the preceding month and climbed by 10% year-on-year (YoY), to 382k units. Higher output, helped by somewhat easing chip supplies, supported the slightly better May sales performance.

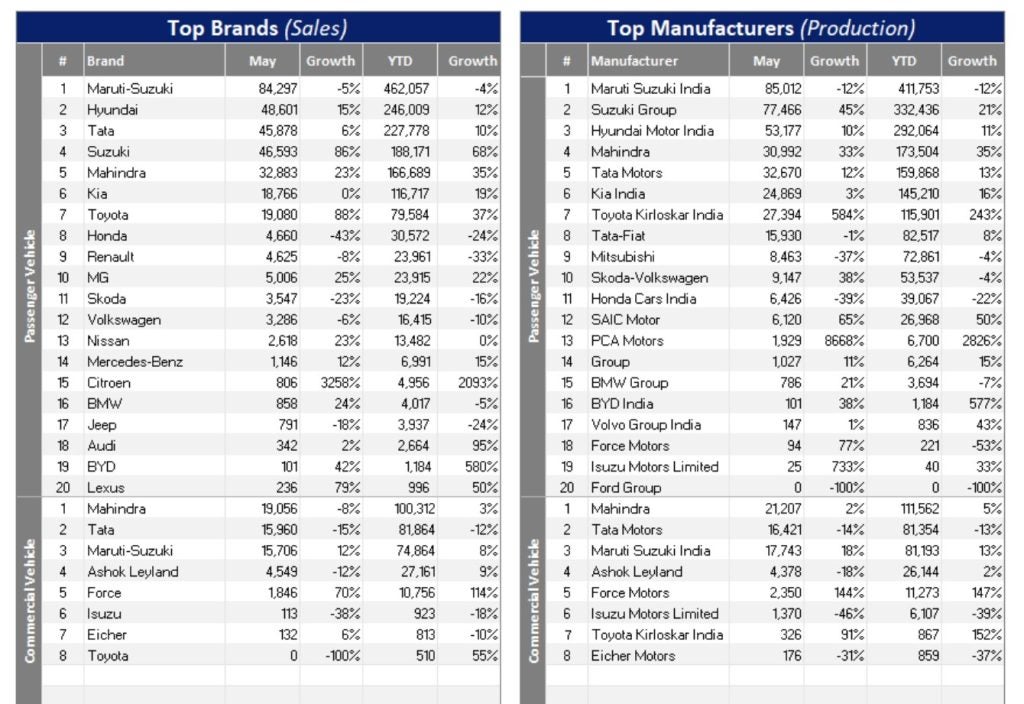

At 325k units, Passenger Vehicle (PV) volumes were on par with April but increased by 13% YoY. Demand for Light Commercial Vehicles (LCVs) with GVW up to 6T surged by 11% month-on-month (MoM) to 57k units, but this total was 5% lower than that in May 2022.

The retail sales of PVs and LCVs in May went up to 340k units, compared to 326k units in April, according to the Federation of Automobile Dealers Associations (FADA).

“In the Passenger Vehicle segment, the improved availability of vehicles, the strength of pending orders, and the robust demand for new launches drove a positive momentum, helping the segment rebound after a slump in the previous month,” said FADA President Manish Raj Singhania.

What is worrying is that India’s average PV inventory has been rising for the past four months. According to FADA, this touched 40-45 days in May (from 39-41 days in April). The dealer body thus cautioned that inventory pressure and right model availability could pose challenges for the PV sector.

Cumulative LV wholesales in the first five months of this year grew by 10% YoY, to 1.94 million units. This figure comprised of 1.64 million PVs (+12% YoY) and 297k LCVs (+2% YoY). That has brought the YTD average selling rate to 4.50 million units/year, compared to record-high sales of 4.39 million units last year.

The sales outlook remains positive in general, but the downside risks to the near-term forecast continue to arise from the lingering chip shortage, elevated prices, and interest rates.

In rural areas, there is a report that rural sentiment has improved, as normal monsoons are predicted. However, possible severe El Nino weather, such as floods and droughts, remains a major risk to the country’s large agricultural sector and rural demand.

In the economy, Q1 2023 GDP growth was better than expected at 6.1% YoY, accelerating from 4.5% in Q4 2022. The main contributors to Q1 growth came from strong government investment and net exports (which reflected weaker imports, i.e., weak domestic demand). Private consumption growth was sluggish at 2.8% YoY.

Looking ahead, falling inflation (4.3% YoY in May) and improving consumer confidence point to an improvement in household spending in H2 2023, while high interest rates and an uncertain global outlook are concerns.

Since LV sales in May were in line with our expectations, the forecast is unchanged from last month. We predict LV sales will increase by 4% YoY to 4.59 million units (a fresh all-time high) this year.

We forecast PV sales to rise by 5% YoY to 3.87 million units, largely bolstered by consistent demand for SUVs, which are estimated to account for half of this volume. At the same time, we project LCV sales to gain by 3% YoY to 713k units.