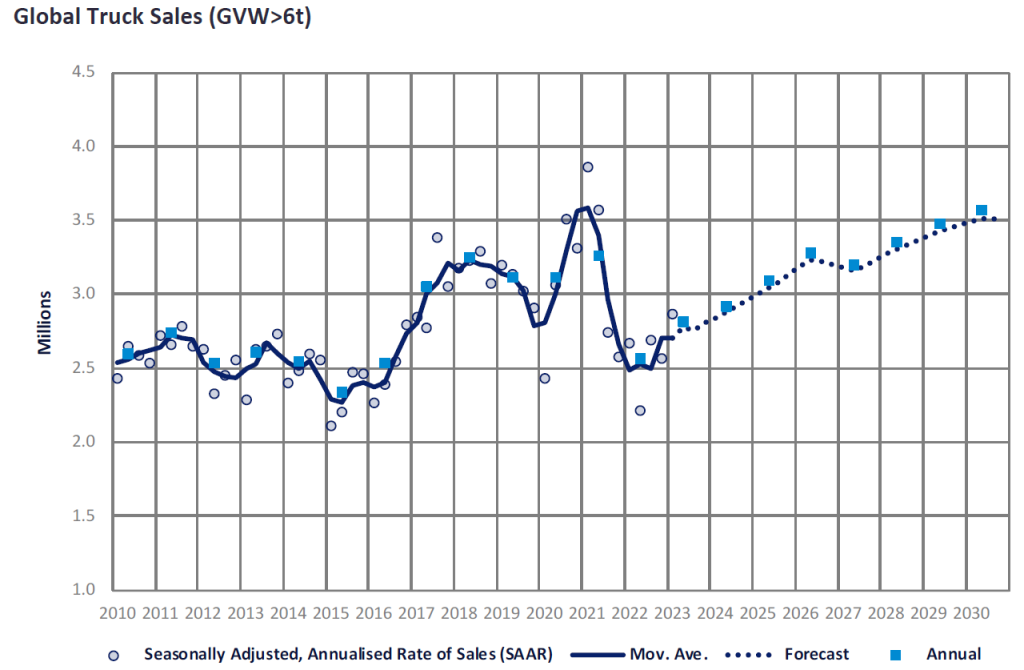

The global truck market outlook has improved over the first half of 2023 as macroeconomic results have surprised to the upside across almost all regions. The baseline sales forecast for 2023 has been bumped up to 2.8 million units (+10%), with lower growth (+4%) now forecast in 2024. The 2023 market is nonetheless expected to remain 10% below its pre-pandemic level.

The decline (vs 2019) is owed almost entirely to developments in the Chinese truck market, which is only gradually emerging into recovery following its emissions-driven slump since 2021. The picture has been rather more positive for medium and heavy truck markets outside China, which posted a combined gain of 6.5% in 2022 – with sales just a shade below the pre-pandemic level – and are poised to rise by a further 2% in 2023.

Macroeconomic drivers of truck demand have outperformed expectations, resulting in broad-based forecast revisions across the major economies. Both the US and eurozone recorded positive growth surprises as their economies proved more resilient than anticipated to high inflation, rising monetary policy rates, and the uncertain economic backdrop. Meanwhile, there was a faster-than-envisaged release of pent-up demand in China after its zero-COVID restrictions were scrapped.

On the supply side, meanwhile, the sector continues to recover from the profound disruption that resulted from shortages of semiconductors, wiring harnesses and other parts, as well as spiking raw materials prices, which hit in 2021-2022. Disruption from this source is not completely resolved even now, but both sales and production have been rebounding in the affected regions in recent months.

The outlook for the emerging truck markets reflects their mixed performance over the past year. Ongoing recovery in the Chinese market will see sales rise by 25-30%, whilst a soft landing is anticipated in India following record expansion in 2022. Meanwhile, the Brazilian market will post a significant decline with sales hit by payback following the Euro 6 emissions changeover in January.

Production expectations have increased since the beginning of the year, with forecast upgrades in North America and Europe, in particular.

European truck production has been ramped up as supply-side constraints have eased; high pent-up demand and long order books support a robust build outlook in 2023. The impending CO2 limits are expected to drive additional volumes in 2024, with payback constraining growth in 2025. The prebuy/payback cycle is likely to repeat in 2029/2030. Moreover, the European Commission’s recently announced Euro 7/VII proposals are slated to take effect in mid-2025 for cars and in mid-2027 for trucks and buses. The regulation seeks to tighten rules on pollutants other than CO2, such as carbon monoxide and nitrous oxide, as well as particulates from brakes and tyres. Automakers are currently lobbying to delay the proposal, which, if implemented as currently proposed, would create additional volatility over the 2026-2028 period.

In North America, the Class 8 build forecast has been bumped up with modest growth now expected in 2023. Production will see payback in 2024. Longer-term expectations reflect the EPA’s recently announced one-step approach to its 2027 mandate: the EPA had originally been proposing a two-step emissions reduction, one step in 2027 and the second step in 2031, effectively driving two prebuys. In its most recent update, however, the EPA has opted to move straight to the 2031 standard in 2027, eliminating the previously anticipated prebuy in 2030.

Overall, global truck production is forecast to grow by 7% in 2023. Beyond 2023, deadlines and other regulatory changes will be driving additional demand in many markets, with cyclical downturns/slowdowns currently anticipated in 2027 and 2031.

Zita Zigan, Director, Global Commercial Vehicle Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Centre