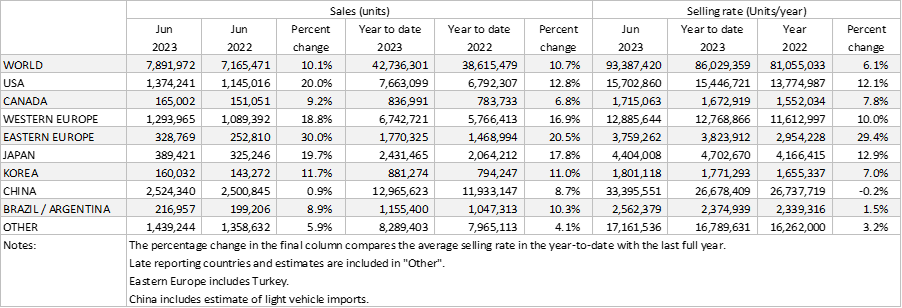

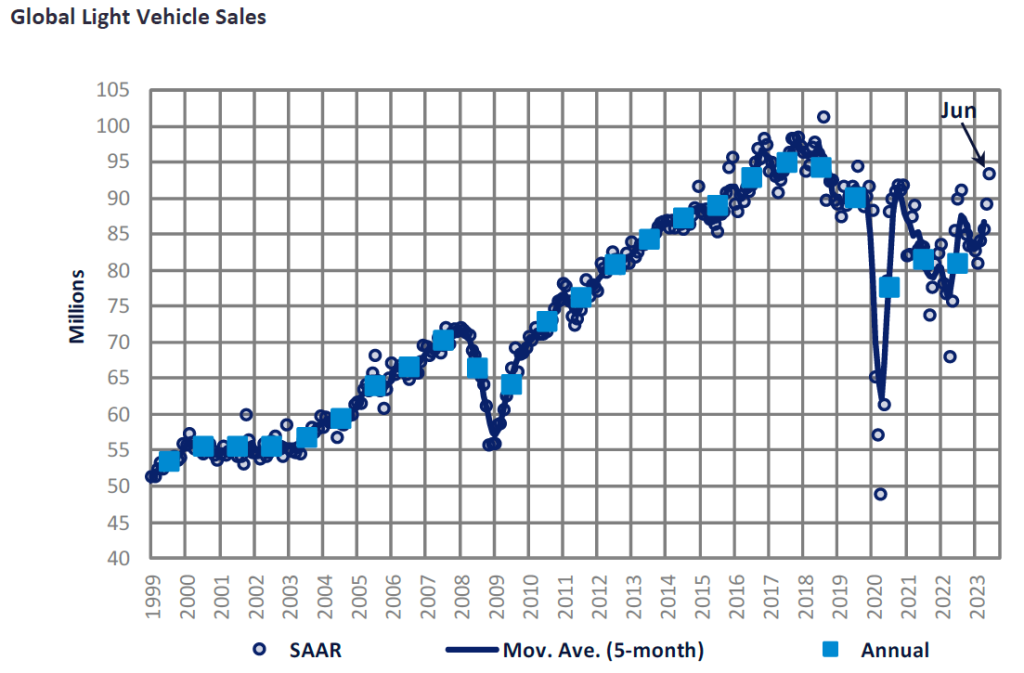

The Global Light Vehicle (LV) selling rate rose to 93 million units/year in June, from 89 million units/year in May. All major markets outperformed June 2022 for just the second time thus far in 2023, supported by the easing of supply constraints. Global LV sales for last month stood at 7.9 million units (+10% YoY).

For a second consecutive month, US LV sales registered 1.4 million units (+20% YoY) as OEMs saw improved vehicle production levels following the easing of supply chain issues. China had the strongest month of the year so far, with a selling rate of 33 million units/year. All major West European countries reported positive YoY growth as their markets continue to recover from the market headwinds in 2022.

A summary of market developments in the world’s regions follows.

North America

The US Light Vehicle market continued to show strong levels in June, as sales increased by 20.0% YoY, at 1.4 million units. The selling rate also increased, reaching 15.7 million units/year in June, up from 15.1 million units/year in May. The average transaction price slightly increased in June, by US$149 to US$46,229 — this could be caused by the diverse product mix as production has been increasing for both lower and higher-profit margin vehicles. Meanwhile, incentives decreased to US$1,736 (though YoY up 89%).

In June, Canadian Light Vehicle sales reached 165k units, an increase of 9.2% YoY. The selling rate also increased, from 1.5 million units/year in May to 1.7 million units/year in June, as the market finally appears to be gathering momentum. Light Vehicle sales in Mexico grew by 25.7% YoY to 113.1k units in June. The selling rate accelerated from 1.3 million units/year in May, to 1.4 million units/year in June, on a par with pre-pandemic levels.

Europe

The West European selling rate in June stood at 12.9 million units/year, broadly in line with that of May; the raw monthly registration figure rose to 1.3 million units (+18.8% YoY). The region’s market has benefited from an improvement in supply constraints and higher delivery rates for consumers. Year-to-date, the region has recorded 6.7 million units (+16.9% YoY).

The East European selling rate grew to 3.8 million units/year in June from 3.7 million units/year in May. LV raw monthly sales increased to 329k units, representing growth of 30% YoY, largely on account of Russia seeing YoY growth of 112% with monthly sales of almost 68k units. With the stronger recovery so far in 2023, raw monthly sales were down just 8% from pre-pandemic 2019 levels.

China

Advance data indicates that the Chinese market accelerated strongly in June. The June selling rate surged to 33.4 million units/year, up nearly 12% from a robust May, and the highest rate since August 2022. In YoY terms, however, sales (i.e., wholesales, which include exports) were virtually flat (+0.9%) in June and increased by 8.7% in H1 2023. NEVs remained the market driver, with their sales expanding by 44% YoY in H1 2023.

According to preliminary reports, however, wholesales in June were boosted by rapidly expanding exports (especially to Russia and exports of EVs), which accounted for about 14% of June Passenger Vehicle sales. Domestic sales were sluggish. While NEVs’ sales growth moderated, sales of ICE models decelerated sharply in H1 2023, due to the end of the temporary tax cut on ICEs in December 2022. Consumers remain downbeat, as the urban youth unemployment rate hit a new record high of 20.8% and the economic outlook is uncertain.

Other Asia

In Japan, the selling rate moderated to 4.4 million units/year in June after a catch-up in production boosted the average selling rate to a strong 4.8 million units/year in the first five months of this year. Yet, sales increased by 20% YoY in June and 18% YoY in H1 2023, supported by the increased supply of semiconductors. Demand remained robust, too. Consumer confidence continued to rise, thanks to strong wage growth, an improving job market, and a rebound in the services sector.

In Korea, the selling rate surged to 1.8 million unites/year in June ahead of the expiry of the temporary excise tax cut, which was extended multiple times over the past few years. However, the rush to purchase new vehicles was muted, partially because the Korean government announced an overhaul in taxation, which resulted in lower taxes for domestically built vehicles from 1 July. (The former tax system used to disincentivize the purchase of locally built vehicles in favor of imports.) In H1 2023, sales increased by 11% YoY, boosted by the temporary tax cut, new model launches, and increased supply.

South America

Brazilian Light Vehicle sales increased by 8.1% YoY in June, as 180k units were estimated to have been sold. The selling rate also increased to 2.1 million units/year in June, from 2.0 million units/year in May. The government incentive program appeared only to have an impact on sales data towards the end of the month. This surge in sales at the close likely caused a decline in inventory, to 224k units, down from 252k units in May. Days’ supply also decreased in June, to 35 days, from 40 days in May.

In Argentina, Light Vehicle sales are estimated to have grown to 37.3k units, up by 13.0% YoY. The selling rate also increased in June, to 445k units/year, up from 425k units/year in May. This is the fourth consecutive month in which the selling rate has exceeded the 400k units/year mark, as the market appears to remain resilient against economic headwinds.